Payroll Service Providers

Improve Efficiency, Increase Accuracy and Promote Growth

As a service provider, you are likely familiar with the challenges of providing high-level customer service and promoting growth while manually managing complex, ever-changing payroll tax regulations.

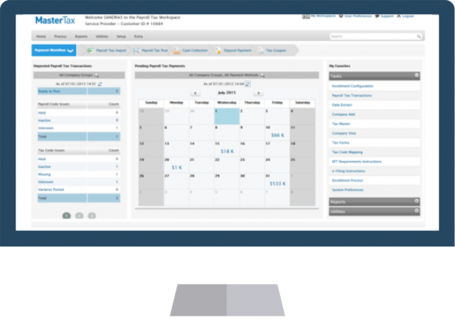

MasterTax software is well-suited for ASOs, large CPA firms, and other third-party providers that prepare and file payroll taxes on behalf of clients. The MasterTax rules database contains the requirements for more than 11,000 payroll tax jurisdictions, so you can be confident you are providing your clients with quality payroll tax processing and service. And because MasterTax is designed to maximize both efficiency and accuracy, it can help you reduce the time spent processing payroll taxes by up to 70%.

Read More