Help Reduce Penalty and Interest Due to Late Filings and Payments

With the support of approximately 11,000 U.S. payroll tax jurisdictions, MasterTax Software can help minimize the risks, especially for employers who file and pay in multiple jurisdictions.

Help Improve Efficiency, Increase Accuracy and Promote Growth

Managing the complexities of ever-changing payroll tax regulations across thousands of jurisdictions can place a significant burden on your business, and put you at risk for penalty and interest assessments.

Ideal for employers with locations and/or employees in multiple jurisdictions, MasterTax Software can help you improve accuracy and efficiency, all while simplifying the payroll tax process. With support of approximately 11,000 U.S. payroll tax jurisdictions, you can be confident you are receiving high quality payroll tax processing software and service.

MasterTax Software Offers These Advantages:

- Company setup is quick and efficient via file import.

- Tax liabilities are automatically scheduled for approximately 11,000 U.S. payroll tax jurisdictions.

- QTD and YTD balancing of paid vs. due liabilities is performed on demand.

- Company-specific packages contain all the relevant forms.

MasterTax Offers Employers These Features

Efficiency

Learn More

- Import company setup and tax liability data from your payroll system into MasterTax Software.

- Schedule and track tax liabilities.

- Generate ACH credit, ACH debit, check, and Fedwire payments.

- Create zero deposits and returns.

- Track refunds and credits.

- Export accounts payable and general ledger data.

- Take advantage of the federal holdback (98%) rule.

- Use analytics to view critical data, uncover issues with transactions and deposits, and track your progress in the payment and quarterly reconciliation cycles.

Accuracy

![]()

Learn More

- Save time and maximize resources while MasterTax Software helps you manage compliance for approximately 11,000 U.S. payroll tax jurisdictions, including federal, state, and most local agencies, as well as the U.S. territories of Guam, Puerto Rico, Virgin Islands, American Samoa, and Northern Mariana Islands.

- Balance QTD and YTD liabilities on demand.

- Produce agency-approved, original and amended paper, e-file and removable media tax returns that are electronically signed or signature-ready.

- Help you stay in compliance with regularly scheduled updates to the MasterTax Software.

Simplify

![]()

Learn More

- Create EFTPS batch enrollment files and prefilled EFT authorization agreements.

- Take advantage of our extensive EFT and e-filing instructions to help you file and pay electronically.

- Produce employer W-2s and annual transmittals, and export employee W-2 data from year-end reconciliation transactions, using our Employer W-2 Reporting module.

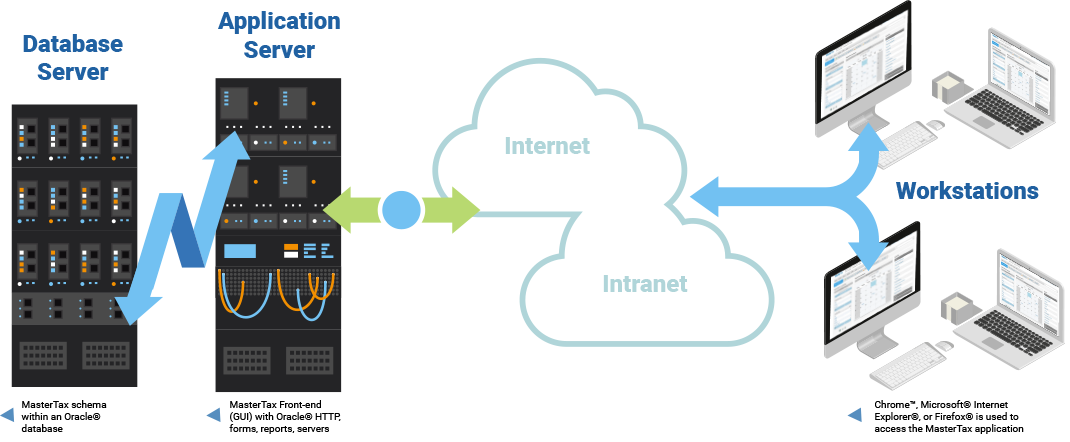

Software Access Options

Companies can choose to use the MasterTax Hosted system, or a premise-based solution.

![]()

Efficiency

Most up-to-date solution

![]()

Ease of Use

Lower learning curve

![]()

Technology

A computer and an Internet connection are all you need