Better Software Helps You Provide Better Service

Filing payroll taxes on behalf of clients has never been easier. MasterTax Software is ideal for ASOs, large CPA firms, and other third-party providers who prepare and file payroll taxes on behalf of clients, enabling them to file more accurately and efficiently.

Help Improve Efficiency, Increase Accuracy and Promote Growth

As a service provider, you know the challenges that are involved in managing complex, continually changing payroll tax regulations, while still providing stellar customer service and promoting growth.

With support of approximately 11,000 payroll tax jurisdictions, MasterTax Software will enable you to provide high quality payroll tax processing and service to your clients. And because it is designed to maximize both accuracy and efficiency, MasterTax Software can help you reduce the time spent processing payroll taxes by up to 70%.

MasterTax Software Offers These Advantages:

- Clients are set up quickly and efficiently via file import.

- Power of attorney forms are prepopulated with each client’s information.

- Tax liabilities are automatically scheduled for approximately 11,000 U.S. payroll tax jurisdictions.

- QTD and YTD balancing of paid vs. due liabilities is performed on demand.

- Company tax packages contain all relevant forms for each client.

MasterTax Offers Service Providers These Features

Efficiency

Learn More

- Import company setup and tax liability data from your payroll system into MasterTax Software directly.

- Schedule and track tax liabilities.

- Impound cash from clients for tax liabilities and fees.

- Generate ACH credit, ACH debit, check, and Fedwire payments.

- Create zero deposits and returns.

- Track refunds and credits.

- Generate unemployment rate requests, and import agency rate files.

- Access archived tax forms.

- Use analytics to view critical data, uncover issues with transactions and deposits, and track your progress in the payment and quarterly reconciliation cycles.

Accuracy

![]()

Learn More

- Save time and maximize resources while MasterTax Software helps you manage compliance for approximately 11,000 U.S. payroll tax jurisdictions, including federal, state, and most local agencies, as well as the U.S. territories of Guam, Puerto Rico, Virgin Islands, American Samoa, and Northern Mariana Islands.

- Balance QTD and YTD liabilities on demand.

- Produce agency-approved, original and amended paper, e-file and removable media tax returns that are electronically signed or signature-ready.

- Help you stay in compliance with regularly scheduled updates to the MasterTax Software.

- Reconcile deposits and cash entries to bank transactions imported from BAI2 files, using the Bank Reconciliation module.

Growth

![]()

Learn More

- Produce prefilled power of attorney forms as you onboard new clients.

- Create EFTPS batch enrollment files and prefilled EFT authorization agreements.

- Produce tax packages containing employer copies of each client’s returns.

- Take advantage of our extensive EFT, e-filing and SUI rate exchange instructions to help you file and pay electronically, and obtain your client’s latest unemployment tax rates.

- Produce employer W-2s and annual transmittals, and export employee W-2 data from year-end reconciliation transactions, using our Employer W-2 Reporting module.

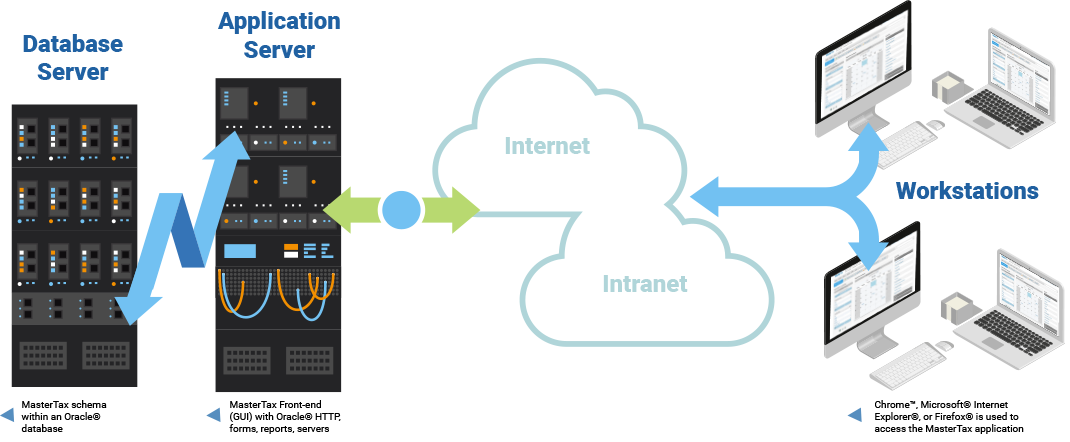

Software Access Options

Companies can choose to use the MasterTax Hosted system, or a premise-based solution.

![]()

Efficiency

Most up-to-date solution

![]()

Ease of Use

Lower learning curve

![]()

Technology

A computer and an Internet connection are all you need